HR 2017: Enough About Millennials, Let’s Talk About Boomers

January 11, 2017 Written by Meredith Brandt

Compare Providers

Download our outplacement comparison sheet

Request Pricing

Compare our rates to other providers

In 2017, HR teams are going to have to focus on not just the generation entering the workforce, but also the generation exiting it. About 10,000 Boomers are retiring every day. The labor force participation rate for the 65+ demographic dropped to 23.6% in the last quarter of 2016, a full percentage point lower than the previous quarter. As we continue into the new year, this pattern is expected to continue.

The question then is: are companies prepared to handle this mass exodus and are they doing everything they can to help these employees transition to retirement?

What will happen to your company when Baby Boomers retire?

“Because older workers because older workers can be the most knowledgeable and most experienced when they retire, that hurts the productivity of everybody left behind, and that drags on the economy through productivity growth,” a video from the Wall Street Journal reports. The Social Security Administration conducted a report four years ago that said by 2015, 48% of supervisors working at the SSA itself would be of retiring age. This is a huge problem for companies in every field. Bosses, supervisors, managers, you name it: people who have been working at your company for years are going to retire. No employee new to the workforce, new to your field, or new to your company will know as much as these employees, since so much is often learned on the job.

What can you do to fix this?

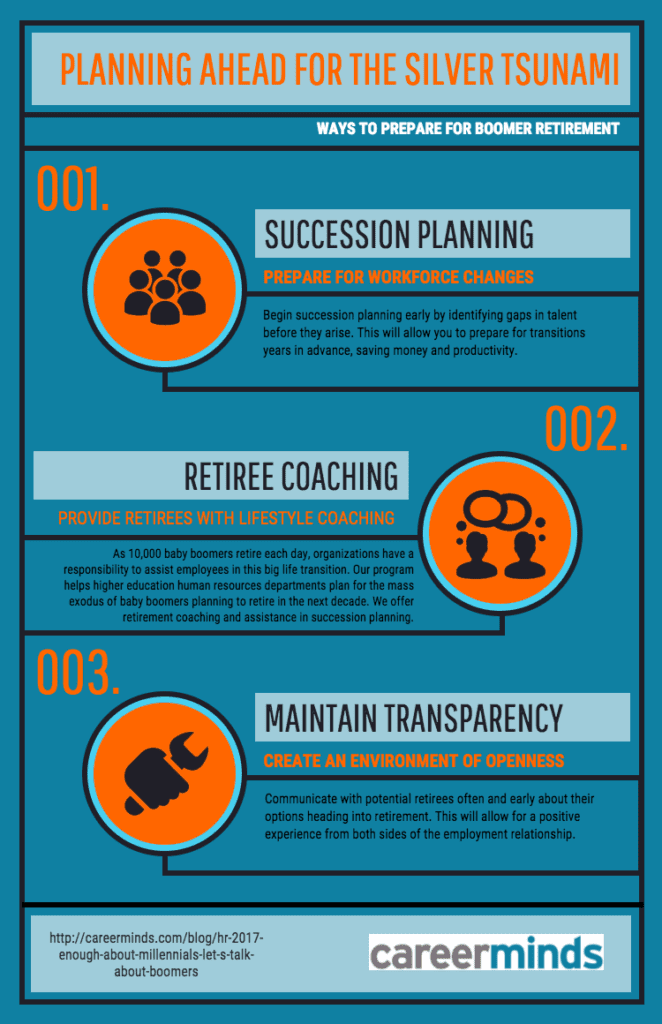

Don’t just look to onboard new top talent. In 2017, you need to make sure you’re focused on succession planning and next generation leadership development. According to an article in Forbes, 91% of millennial employees aspire to leadership positions, but their biggest weaknesses are technical expertise and influence. These weaknesses are the strengths of the Boomers leading the way before them, so in order to bridge this knowledge and influence gap, you could try some of the following:

- Before your Boomers go, create mentorship programs for newer and more experienced employees.

- Focus on leadership training by using an executive development and coaching program at your company.

- Pinpoint top talent already working at your company and provide them with opportunities to take on more leadership roles.

- Begin succession planning early by identifying gaps in talent before they arise.

What will happen to your Baby Boomer employees when they retire?

Many of your Baby Boomer employees have been saving for retirement for years. However, they may be meeting these final days in the workforce with less readiness than they intended. According to a Health and Retirement study, the share of adults age 65 and older with debt increased nearly 15% from 1998 to 2012. The recession took a toll on many people’s savings, but reports from the last few years have showed continued problems for retirees. An article in Time Magazine said, “The percentage of boomers who report feeling satisfied with their economic situation has plunged the last four years.” It cites a report that claims only 43% of Boomers are satisfied with their retirement plans yet in 2012 that number was as high as 79%.

But Boomers aren’t just facing unexpected challenges financially. A New York Times article said, while many focus on their finances looking ahead, “it’s far harder to compute in advance how to best navigate the intangibles like building a new social network and finding value in how you spend your time in retirement.” Today, people can expect to live another twenty, thirty, even forty years after they leave the workforce. How are retirees going to spend their time?

What can you do to help them?

HR teams should make sure they are doing all they can for this generation that has had such an impact on their company and on the workforce. Boomers will face many challenges in their retirement, and while there is of course little for companies to do once these employees have left their positions, there are things to do to ease their transition. Some things you can do are:

- Offer employees flexibility to phase into their retirement by letting them work part time, lessening their responsibilities, or offering more flexibility regarding location.

- Take the time to give people extra help to examine or redefine their financial planning strategies.

- Provide a retirement planning and coaching service to help your employees plan for more than just their financial future.

- Identify employees who need may need additional help in understanding their retirement packages or using their benefits to the fullest.

This new year is going to bring plenty of challenges to your company. Don’t let this retirement wave be one of them. Be there for your company and be there for your retiring employees by being prepared.

In need of outplacement assistance?

At Careerminds, we care about people first. That’s why we offer personalized talent management solutions for every level at lower costs, globally.